Travel Insurance rabo Don tafiya Cost Of Life: Kina Overpaying?

- Yadda tafiya inshora aiki

- Basic inshorar kiwon lafiya

- Travel inshora ga wasanni

- Kaya asarar inshora

- buguwan giya inshora

- Ɓangare na uku hari inshora

- Travel sokewa inshora

- Travel inshora siyasa

- Abin da ya nemi a lokacin da zabar inshora

- Me yi da sharuddan nufin

- Policyholder (beneficiary, inshora)

- Insurer (inshora kamfanin)

- inshora hali

- Sum inshora (ɗaukar hoto adadin, alhaki iyaka)

- Taimakon (sabis kamfanin)

- Mallaka

- Yadda inshora da aka biya

- Lokacin da zai yi tafiya lafiya inshora aiki?

- Yadda hažaka asali inshora

- Travel Insurance

- Tambayoyi Akai-Akai

Travel inshora ake bukata don tafiya kasashen waje. Ba tare da shi, ba su shirya yawon shakatawa da kuma ba sa wani visa. Samun rashin lafiya, ko ji rauni a kasashen waje ba tare da ko kadan inshora ba kawai a dubious yardarSa, amma kuma wani gagarumin naushi ga kasafin kudin.

A inshora kamfanin ne ba ta da alhakin gudu da kuma ingancin kiwon lafiya, amma Service Center ko Taimakon - wani tsakiya tsakanin insurer da likita kungiyar. Ya ma alhakin likita kira da kuma asibitin jeri.

Don gano wanda za mu bauta maka, dole ne ka a hankali karanta inshora sharuddan da yanayi. Idan wani matafiyi da dama rashin lafiya yayin da hutu, ya kamata kira Taimakon, kuma ya za riga lamba da kuma yi shawarwari tare da likitoci.

Akwai nau'ikan inshora daban-daban, daga mutum wanda kuma ya rufe tafiya zuwa mafi yawan idan ba duk ƙasashe ba, ko takamaiman waɗanda don lokacin tafiya. Bari mu mai zurfi cikin wannan takamaiman bayani mai mahimmanci!

Yadda tafiya inshora aiki

A general, za ka iya inshora wani abu, la'akari kawai na yanzu iri tafiya inshora.

Basic inshorar kiwon lafiya

A mafi kasafin kudin inshora ake bukata kafin su sami tafiyarsu, wanda koda halin kaka da dama da ɗari rubles. Shi ne m, amma shi ne iya kare yayin da tafiya da kuma samar da wani m sa na ayyuka.

Ya danganta da inda matafiyi ne tafiya, za ka iya ƙara zažužžukan to wannan inshora: daga taimako da jellyfish cizo zuwa asibiti domin rikitarwa ciki. Idan matafiyin yana da nasaba ko kullum cututtuka, ya aka rika rubuta ƙarin zabin cikin manufofin. Za a kasar inda magani ne tsada sosai, za ka iya yi inshora don har zuwa dubu 50 Tarayyar Turai, da kuma ba up to 30, kamar yadda a cikin wani misali da manufofin.

Travel inshora ga wasanni

Extended inshora zaɓi don magoya na aiki da kuma matsananci hutu. Shi, ba shakka, shi ne mafi tsada fiye da asali daya da kuma dogara a kan irin aiki da matafiyi da yake faruwa a tafiyar da, dole ne a nuna a lokacin rajista.

Ya kamata a lura cewa doki hawa, hawan keke, ATV da kuma babur hawa kuma dauke da wani aiki hutu.

Kaya asarar inshora

A cewar daban-daban kafofin, game da 2% na kaya da aka rasa a kowace shekara a lokacin flights. Saboda haka, kamfanonin inshora bayar da inshora da akwati tare da abinda ke ciki - don haka idan akwai wani asara, matafiyin zai akalla sami diyya.

Amma kuma, kamar yadda da wani inshora, yana da muhimmanci a karanta kwangila a nan: inshora ba rufe kudi, kayan ado da duwatsu masu daraja, da takardun, na'urorin kiwon lafiya da kuma wasu masu tsada abubuwa. Suna kullum inshora dabam.

buguwan giya inshora

Eh, irin inshora ma akwai, duk da haka, kawai daya inshora kamfanin, da Jamusanci ERV, yana da irin wannan kunshin na sabis don haka yanzu. Ya tabbatar da kula da lafiya, ga cututtuka, ko jikkata sakamakon barasa, miyagun ƙwayoyi ko mai guba maye. Wannan shi ne kusan na musamman da sabis, saboda mafi yawan kamfanonin la'akari da barasa maye ba wani da inshora taron.

Ɓangare na uku hari inshora

Yana zai zo a m idan wani matafiyi yana tafiya zuwa wata kasa da wani babban laifi kudi, da kuma kawai idan ya ji tsõron cewa ya iya sata - akwai mai yawa na barayi suka riba daga m yawon bude ido ko a m kasashen.

Travel sokewa inshora

Irin wannan inshora Rama ga halin kaka na tafiya, idan matafiyin yana da zuwa katse hutu ko soke shi gaba ɗaya - sun bai ba da visa, manta biya haraji, ko canza tsare-tsaren.

musamman gaskiya ga waɗanda ake shirin wani hutu rabin shekara kafin nufin tafiya ko fiye. Wannan shi ne daya daga cikin mafi tsada insurances, da kudin farawa daga 8% na yawon shakatawa farashin.

Travel inshora siyasa

Domin tafiye-tafiye a fadin Rasha, na yau da kullum wajibi inshorar kiwon lafiya da manufofin isa. Amma idan ba zato ba tsammani wani matafiyi yana son matsananci yawon shakatawa da kuma tafiya sau da yawa, sa'an nan ya bada shawarar ya dauki fitar da wani tafiya inshora siyasa.

Bugu da kari to ananan harkokin kiwon lafiya, shi ya hada da wasu ƙarin ayyuka: daga Extended bincikowa zuwa sufuri na wanda aka azabtar, idan ba zai iya matsawa da kansa, ko zai kasance har yanzu a asibiti a lokacin da tashi tare da tikiti.

Insurers musamman bayar da shawarar tunani game da wannan shiri zuwa ga masoya na yawo, da hawan duwatsu da kuma gudun kan.

Abin da ya nemi a lokacin da zabar inshora

Kana bukatar ka zabi ba da inshora kamfanin kanta, amma da taimakon - shi ne tare da su cewa matafiyi zai magance idan an da inshora aukuwa ta auku. Feedback a kan aikin na taimako za a iya samu a kan m musamman shafukan. Yana da muhimmanci a tuna cewa wasu kamfanonin inshora hadin gwiwa tare da dama taimako da sabis a lokaci daya.

Inshora ya kamata a zaba ba tare da wani deductible. A kamfani ne da wani adadin da cewa wani kamfanin iya ba biya. Alal misali, idan inshora yana da wani deductible na 40 Tarayyar Turai, da kuma likita ta doka ne 60 Tarayyar Turai, sa'an nan kamfanin zai biya kawai 20 Tarayyar Turai, da kuma sauran adadin zai yi da za a biya daga aljihu. A cikin 'yan shekaru, insurances da deductibles ba kowa, su ne yawanci mafi arha.

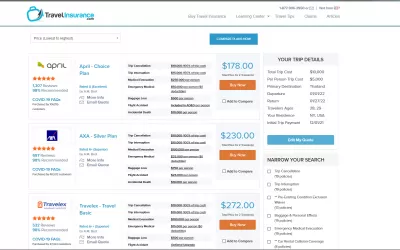

Kafin buying, ba za ka iya kwatanta tayi daga daban-daban kamfanonin inshora. Wannan kuma za a iya yi a kan musamman kwatanta shafukan. Don yin wannan, kana bukatar ka zaɓi ƙasa, ranar tafiya, da lambar kuma shekaru na vacationers, shafin zai da kansa zaɓi da kuma nuna duk yiwu tayi.

Inshora ya kamata a dauka ba kwanan wata a ranar, amma kadan da gefe, musamman idan matafiyin yana jiran mai tsawo da kuma wuya jirgin tare da sadarwa.

Yana da muhimmanci a ziyarci likitan hakori a dace hanya - saboda matsa lamba da kuma yawan zafin jiki canje-canje, untreated hakora iya cũtar da su, kuma hakori sabis, fãce gaggawa su, suna ba ta rufe wani kamfanin inshora.

Me yi da sharuddan nufin

Policyholder (beneficiary, inshora)

A policyholder (beneficiary, da inshora) ne ku duka, ba uku daban-daban mutane: wannan shi ne abin da ka iya kira a cikin inshora kwangila.

Insurer (inshora kamfanin)

Insurer (inshora kamfanin) - an organization with which you conclude a contract, it pays for treatment and other expenses for an insured event.

inshora hali

Inshora taron - wani taron cewa an sadãki da kwangila da kuma ga abin da insurer zai biya diyya. Akwai wani abin da ba a rufe ta da inshora yana dauke da wani ba-da inshora taron da kuma ba za a reimbursed.

Sum inshora (ɗaukar hoto adadin, alhaki iyaka)

Sum inshora (ɗaukar hoto adadin, alhaki iyaka) - the maximum that the insured will pay for you. This amount includes hospital expenses, medical transportation and everything else. If you have chosen to cover 30 thousand dollars, and a helicopter from the Kamchatka volcano cost 10 thousand, 20 thousand will remain for treatment.

Taimakon (sabis kamfanin)

Taimakon (sabis kamfanin) is your travel assistant. If you are sick, call the assistance, and they will call the rest. Their job is to call an ambulance, find a hospital, arrange transportation, and solve problems along the way.

Mallaka

Deductible ne adadin da cewa insurer iya ba biya bisa ga inshora kwangila. Mafi sau da yawa, da kamfani ne mika wuyansu, cewa shi ne, shi ne ya biya a cikin wani akwati. Alal misali, a ce kana sami inshora da $ 30 deductible. A hutu, your makogwaro cũta, kuma ka je wurin likita wanda billed $ 45. Daga cikin wadannan, za ka biya $ 30 da kanka, da kuma $ 15 - da inshora kamfanin. Deductible manufofin ne mai rahusa, amma idan wani da inshora taron ya auku, da tanadi ne wata ila za a rasa. Saboda haka, gogaggen matafiya fi son inshora ba tare da wani deductible.

Yadda inshora da aka biya

Akwai biyu inshora biyan zažužžukan: ko dai da inshora biya asibiti kai tsaye, ko ka biya a kan tabo, sa'an nan da inshora zai wadãtar da ku.

Service inshoraService inshora is the most popular. This is when the insurance company sends money for treatment directly to the hospital. You don't pay the bills yourself, except in very rare cases: for example, a hospital in the jungle of Borneo only takes cash. In such a situation, the assistance will ask you to pay on the spot, and when you return home, the insurance company will reimburse everything.

diyya inshoradiyya inshora is when you pay for the treatment yourself, then collect the documents, bring them to insurance and get your money back. It should be said that such insurance is almost never found now.

Lokacin da zai yi tafiya lafiya inshora aiki?

- Stung da wani jellyfish.

- Stung da wani jellyfish a lokacin da koyon surf.

- Inshora ga wasanni da kuma waje ayyuka.

- Fãɗi, bata sani, farka - filastar simintin gyaran kafa.

- Ya tafiya bugu, fadi, bata sani, farka - filastar simintin gyaran kafa.

- Taimako a gaban giya maye.

- Dined a gida abinci da kuma samu guba.

- Dined a gida abinci, da kuma gastritis tsananta.

- Taimako da exacerbation na kullum cututtuka.

Yadda hažaka asali inshora

Don gaske kare your inshora, ƙara ƙarin zaɓuɓɓuka don ka tushe da manufofin. Ga wasu ra'ayoyi:

- Idan za teku - add taimako ga kunar rana a jiki;

- Idan da za ku trekking, gudun kan ko hawan igiyar ruwa - add inshora ga waje ayyukan da wasanni. Duba dukkan ayyukan da za ku yi.

- Idan kana so ka cinye bakwai-thousander ganiya - ƙara ba kawai wasanni inshora, amma kuma bincika da kuma ceto ake gudanar da helikofta fitarwa.

- Idan ka sha wahala daga ciki ulcers ko wasu kullum cututtuka - add taimako da exacerbation na kullum cututtuka.

- Idan za ka hau wani moped ko babur - ƙara wannan zabin, shi ne ake kira da cewa. Domin ga inshora kamfanin zuwa maida kome da kome ba tare da tambaya, kana bukatar ka tafi a kwalkwali, kuma tare da kasa da kasa category A hakkokin;

- Idan kana tsammani a baby, ƙara taimako a cikin hali na rikitarwa ciki. Just ka tuna: 'yan mutane inshora ciki har zuwa 31 makonni, mafi sau da yawa har zuwa 24 ko 12 makonni.

- Idan ka so ka zauna tare da gilashin ruwan inabi - ƙara taimako a cikin hali na giya maye. Gaskiya, daya kawai inshora kamfanin yana da irin wannan wani zaɓi - ERV, da shirin da aka kira Optima. Sauran insurers bazai mayar maka idan ka kasance tipsy. Haka kuma, wasu za ki biya kawai idan maye sa da hadarin, yayin da wasu ba za su biya a cikin wani akwati. Ambato: gwajin for barasa abun ciki yana da wuya a yi, don haka yana da muhimmanci yadda isasshen za ku zama a cikin ra'ayi na likitoci.

- Idan kana so ka amince ka mallakarmu, ƙara kaya inshora. Idan ka akwati aka rasa, ba za ka samu $ 500-2000 domin shi (ka zabi da adadin da kanka idan ka zana har da manufofin). Ba tare da wannan inshora, kamfanin jirgin sama zai biya - sau da yawa $ 20 da kilogram.

- Idan kana damu game da fasfo - add daftarin aiki inshora. Wanda idan, za a reimbursed ga kudin na maido.

- Idan kana damu game da yin makale a filin jirgin sama, ƙara jirgin da bata lokaci ba da inshora. A jirgin sama ba za su yi kashe sauri, amma ku za a biya domin kowane awa daya na jiran (sai dai na farko 4);

- Idan ba ka so ka biya domin lalacewar bazata sa zuwa wani mutum, ƙara alhaki inshora. Idan ka bazata bumped a cikin wani skier yayin natsu, muna saye da inshora kamfanin zai biya domin lura da bruises da saya sabon kayan gudun kan maye gurbin karya wadanda;

- Idan kana da wani shirin hutu a gaba, ƙara sokewa inshora. A wannan yanayin, idan kana ƙaryata game da wani visa ko ka fada da rashin lafiya kwana biyu kafin tashi, da insurer zai dawo da kudi ga tikiti, hotel-hotel da sauran biya sabis.

- Idan kana son wani gida kwai zuwa mayar da kiwon lafiya, ƙara hatsari inshora. Bari mu ce ka karya kafar hutu. Za a bi da a kan tabo tare da saba tafiya inshora. Kuma idan kana da wani Extended siyasa, sa'an nan a gida su ma za su biya diyya, wanda za a iya ciyar da ko a kan fi, ko a kan wani sabon smartphone.

Travel Insurance

Travel Insuranse ne mai kwazo kungiyar da ta sa shi sauki kwatanta da saya tafiya inshora da tsare-tsaren daga dukkan manyan insurers a kasa da minti biyar.

Domin amfani da sabis, ku kawai bukatar ziyarci shafin, inda za ka bukatar ka shigar da tafiya bayanai don gano farashin daban-daban da kamfanoni da kwatanta su.

Abin da za a iya faralta a sami up-to-date bayanai:

Cost na tafiya: duka biyu jimlar kudin da kudin da mutum za a iya nuna. Dole ne ka shigar da total adadin your ba a rama kudi da aka biya kafin lokaci tafiye-tafiye da za a inshora (iska tikitoci, hotels, yawacen duniya ta ruwa).Babban manufar: a nan kana bukatar ka nuna kasar da za ka ciyar da mafi lokaci a lokacin ka fara tafiya. Dole ne ka zabi daga jerin.

Kwanakin tafiyaKwanakin tafiya: the date of departure and the date of return are indicated here;

Yawan matafiyaYawan matafiya: you can specify from 1 to 10.

Shekarar matafiya (na yau);Gidan na dindindinGidan na dindindin: you can choose the USA, Canada, and there is also the option “I / we live outside the USA or Canada”. You also need to select a state from the list;

'Yan ƙasa;Ranar biyan bashin asaliKwanan bayan farko - Anan kuna buƙatar zaɓi kwanan wata lokacin da kuka biya don tafiya gaba ɗaya ko a sashi. Idan an yi amfani da abubuwan sakamako yayin yin booking kuma ba a yi wani ainihin biyan kuɗi ba, to ana ganin cewa baku sayi ba tukuna.

Tambayoyi Akai-Akai

- Zai yi tafiya inshora kare ni daga hadari yayin tafiya?

- Tabbas, inshora ba zai kare ku daga haɗari, bala'o'i, cututtuka da sauran m abubuwa. Amma zai taimaka rufe asarar ka bayan irin wadannan matsaloli.

- Ta yaya matafiya za su ƙayyade idan sun kasance suna wuce gona da iri game da inshorar tafiye-tafiye zuwa farashin tafiyarsu?

- Matafiya za su iya kwatanta farashin inshora a kan jimlar kudin tafiya da kimanta da ɗaukar hoto. Gabaɗaya, inshora ya kamata ɗan ƙaramin adadin kuɗin tafiya. Yakamata suma suna kwatanta manufofi daban-daban don tabbatar da cewa suna samun adadin gasa don ɗaukar hoto da suke buƙata.