Limits of credit cards international travel insurance

- Visa and Mastercard travel insurance

- Who is covered by credit card insurance

- How long are you covered abroad

- How to use credit card insurance

- What does travel insurance cover

- Cancel for any reason travel insurance

- Travel baggage insurance

- Civil liability insurance

- Why do you need travel insurance

- Cheapest travel insurance for Schengen visa

- Worldwide travel insurance compare

- Which travel insurance

- Frequently Asked Questions

Visa and Mastercard travel insurance

Do your credit card provides travel insurance? When going abroad, and counting on the Visa or Mastercard included travel insurance, make sure that you understand the limits of these insurances from bank cards. It might be important to take a separate international travel insurance.

There are two types guarantees: insurance cover (death / invalidity, luggage, cancellation, delay, civil liability) and assistance guarantees (medical expenses in case of accident or illness, medical repatriation, early return, etc.).

Who is covered by credit card insurance

Most credit cards cover the the cardholder, the spouse, cohabiting partner or cardholder's spouse, his / her children under the age of 25 who are single and tax-dependent, whether or not they travel with the cardholder, his unmarried grandchildren under the age of 25 and his tax-dependent ascendants, providing they are traveling with the cardholder.

How long are you covered abroad

Here is a catch that might be a big problem for big travelers. The insurance cover is most likely only during the first 3 months of your trip with Visa, Visa Premier, Mastercard and Gold Mastercard. This coverage begins if you are more than 100 km away from your home.

For the assistance guarantees, they might also apply only for the first 3 months of the trip with Visa, Visa Premier, Mastercard and Gold Mastercard, but begin outside the country of residence.

How to use credit card insurance

To activate and use the insurance guarantees from your credit card, you must have paid totally or partially the trip with your credit card. This depends on the bank, and must be checked. The possible refund will depend on the total trip amount.

For the guarantees of assistance to apply, the possession of a valid card can be enough. It is necessary to contact the assistance before any incurring expenses.

What does travel insurance cover

Regarding health expenses, with entry-level cards, reimbursement might not be sufficient in countries with high health costs, such as North America, Asia or South Africa, where a day of hospitalization can reach up to 7500€.

Maximum reimbursement with Visa and Mastercard simple, is usually limited to 11000€.

The maximum reimbursement with Visa Premier and Gold Mastercard can be up to 155000€.

On top of that, beware of credit cards applying a deduction on all refunds. It is often the case that a deduction of 50 to 75 applies. For example, using a Mastercard, consulting a doctor for a cost of 100€, only 25€ will be refunded, as a deduction of 75€ is applied to every single expense.

Cancel for any reason travel insurance

Using Visa and Mastercard, the change or cancellation of a trip is not covered at all.

If you are using Visa Premier or Gold Mastercard, you are covered only in the event of death of a family member, serious harm to your home or economic dismissal. In all other cases, the cancellation insurance is not valid, and no change will be reimbursed.

For all cards, the cancellation guarantee caps are 5000€ per year and per card.

Travel baggage insurance

When the baggage is lost, damaged or stolen, Visa and Mastercard do not cover anything.

With Visa Premier or Gold Mastercard, you are covered from 800 to 850 € per piece of baggage lost, damaged or stolen. There might be a deduction of 70 € applied on the total amount of the damage. The insurance only works if the baggage was placed under the responsibility of a public carrier.

Civil liability insurance

Visa and Mastercard do not cover you for civil liability while traveling.

Visa Premier card covers your civil liability for up to 1525000€.

A Gold Mastercard will cover you for civil liability up to 2000000€.

Why do you need travel insurance

With an international insurance you benefit from a much better coverage than the one offered with a credit card, and it can be adjusted to your exact needs, such as:

- insurance for more than 3 months, for the period of time you need,

- having real health coverage with higher maximum reimbursement amounts, up to 1000000€ per year, and lower or no deductibles at all,

- with a cancellation guarantee, you are covered for a very large number of travel cancellation cases and the guarantee ceilings are much higher,

- with the luggage insurance guarantee, you are guaranteed in case of theft, loss or destruction occurring during the return trip or during the stay,

- with the civil liability guarantee, you are insured for damage caused to others.

Cheapest travel insurance for Schengen visa

With insurance such as AllianzTravel, a travel insurance for Schengen visa can start at 15€ for a 2 days trip to a Schengen country, and go up to 90€ for a 3 months trip, which is usually the maximum amount of time allowed for a trip in the Schengen space.

Travel Insurance - Affordable Plans Starting at $23 | Allianz GlobalWorldwide travel insurance compare

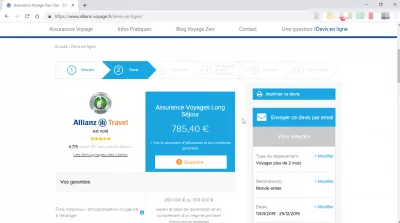

Looking for an worldwide travel insurance, for example for a one year World Tour trip, we found round the world travel insurance for no less than 750€ with Allianz Travel.

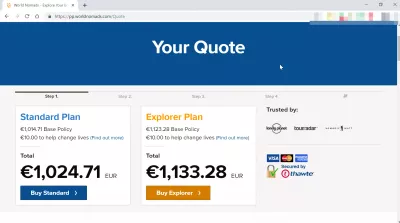

Therefore, a cheap worldwide travel insurance should be considered at around 750€ with AllianzTravel, but that can easily go up to 1000€ and more with other insurances like WorldNomads.

Travel Insurance - Affordable Plans Starting at $23 | Allianz GlobalWorld Nomads international travel insurance quote

Which travel insurance

After having had a look at this guide, you might be wondering which travel insurance to take.

The best solution is to check the website of your credit card, and make sure that the travel insurance and assistance they offer is high enough and will cover your trip needs.

Otherwise, you need to take an insurance that starts in your home country. Try the amazing AllianzTravel insurance if available in your country.

Mastercard - Global Leading Company in Payment SolutionsVisa - Leading Global Payment Solutions | Visa

Travel Insurance - Affordable Plans Starting at $23 | Allianz Global

Frequently Asked Questions

- What are the typical limitations of international travel insurance provided by credit cards, and how can travelers supplement these policies?

- Limitations may include coverage caps, exclusions for certain activities, and short coverage periods. Travelers can supplement these policies with standalone travel insurance that covers broader scenarios and offers higher coverage limits.

Michel Pinson is a Travel enthusiast and Content Creator. Merging passion for education and exploration, he iscommitted to sharing knowledge and inspiring others through captivating educational content. Bringing the world closer together by empowering individuals with global expertise and a sense of wanderlust.