Buy Travel Insurance, An Added Advantage For Tourists

- Buy travel insurance, an added advantage for tourists

- Why is it essential to take out travel insurance?

- Choosing the right travel insurance for your traveler profile

- The different types of travel insurance to take out before going abroad

- The guarantees offered when taking out travel insurance

- Other guarantees to include in your travel insurance contract

- What about trip cancellation or modification insurance?

- How to chose a travel insurance?

- Travel insurance information and specifics:

- Frequently Asked Questions

- Comments (1)

Buy travel insurance, an added advantage for tourists

When vacationing abroad, you are not always safe from any incidents. This is why it is often recommended that every traveler think about taking out travel insurance. At least, thanks to this cover, they will have the privilege of benefiting from exceptional care in the event of an accident. Explanations.

Why is it essential to take out travel insurance?

The unexpected is not lacking during a stay abroad. Sometimes we lose luggage, we get sick or we have to deal with the cancellation of a flight. Several events risk spoiling the atmosphere. In order to face any kind of eventuality, it is better to prepare in advance thanks to the subscription of a travel insurance. It is an insurance contract which guarantees your protection during all your travels abroad. The solutions offered by insurance companies vary according to the need of each adventurer. As a result, the contracts available will be determined according to the various policies available on the market. There will thus be the basic guarantees included in the travel insurance. Then, the insured can also have other optional guarantees presented at the level of each insurer. Find in this section all the information you need to know about the reasons for taking out travel insurance.

Choosing the right travel insurance for your traveler profile

The usefulness of choosing a travel insurance adapted to your profile helps to facilitate the implementation of your cover. Each expedition and each adventurer each have specific traits. Therefore, one cannot always guess what will happen during the trip. In other words, it turns out to be impossible to anticipate everything, hence the need for insurance to cover the entire shipment. In case of worries during a trip, your insurance prevents you from being left to your own devices. So, to be covered in case of illness, be sure to find out all the formalities to follow. That said, if you are ill abroad, Social Security will not cover your medical expenses. By taking out travel insurance when you book, you will benefit from adapted treatments if necessary.

The different types of travel insurance to take out before going abroad

When choosing travel cover, it is imperative to check the guarantees covered by your insurance. This mainly concerns the facts that can generate various possible cases such as illness, loss or deterioration of luggage, etc. To find out more, you must inquire about the limits of these guarantees as well as the applicable deductibles. Added to this are the exclusions from travel insurance guarantees. Among the types of travel insurance to choose, we can cite, among others, travel cancellation insurance, repatriation insurance, luggage insurance, etc. If you are still a student, you can opt for study abroad travel insurance. For information, some insurance companies also offer their policyholders offers including third party liability abroad. This allows you to protect yourself in the event of damage caused to others and their consequences during your stay.

The guarantees offered when taking out travel insurance

Travel insurance is a kind of protection that covers you during your stay abroad. The guarantees in your contract thus vary according to the chosen destination, the duration or the nature of the stay for example

click hereThey are systematically offered when you book your stay with a specialized organization. This can be a travel agency association or a Tour Operator. To find out about all the additional guarantees offered by your insurance, the best alternative is to use an online insurance comparator. It is a powerful tool for collecting all travel insurance benefits so that you can find the guarantees that meet your expectations. They vary according to travel insurance contracts. However, it should be noted that all the policies relate to medical expenses and hospitalization, assistance and repatriation, and finally civil liability abroad. Overall, these are the basic guarantees.

Other guarantees to include in your travel insurance contract

In addition to the basic guarantees, the traveler can also add other additional guarantees to their contract to leave with peace of mind. Each independent insurance company remains free to define the scope of the travel insurance contracts offered to their customers. To get an idea, there are two types of complementary guarantees. On the one hand, there are those that are already included in the travel insurance contract defined by the insurer. On the other hand, we can count on those offered as an option in the contract. These can be subscribed or not according to your desires. Note that travel insurance has two components. There is the insurance component that takes care of compensation or reimbursement. And as for the other part, it generally concerns the assistance and support offered by the insurer in the event of an incident during the stay. This is all part of the coverage offered in the event of travel insurance.

What about trip cancellation or modification insurance?

This kind of insurance is a kind of guarantee specially established to reimburse you for part or all of the costs incurred if you can no longer leave. To be “eligible” for this trip cancellation or modification insurance, the reason for your cancellation must be part of the policy. For this purpose, this type of insurance can be taken out, either as an option, as an additional guarantee. Either, it should be considered as a full-fledged travel insurance contract with an independent insurer. A trip or an airline can also grant this type of travel insurance contract. These coverages marketed by independent insurers are said to be “all causes justified”. So just because you don't want to leave for personal reasons is not a valid reason at all. Only an unforeseeable event remains acceptable: refusal of visa, accident, redundancy, etc.

How to chose a travel insurance?

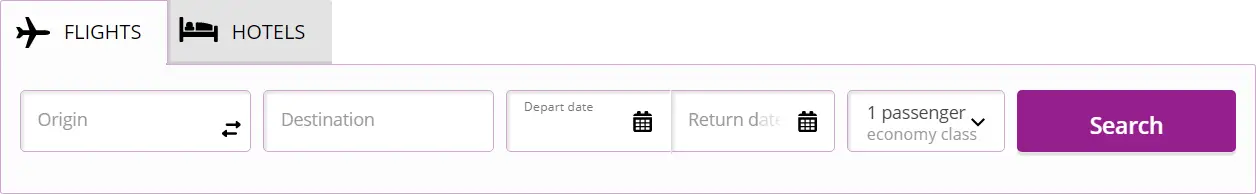

While there is no general rule, you should make sure that the insurance will cover all of your specific needs, such as cover all countries in which you are intending to go, for the duration of the whole trip including possible changes, and that it covers not only the minimum required to enter the countries in which you are traveling, but also other issues that you might face, such as luggage delay or flight cancelled that might need you to trigger your travel insurance in order to get expenses covered.

In my case, while preparing to travel for my year long World Tour and before leaving, I got a yearly travel insurance that covers all countries (except North Korea) for most if not all possible issues, in order to be fully covered. The World Nomads travel insurance or the Visitors Coverage travel insurance both are great option in that sense for long term travelers and for digital nomads as well, making sure that you won’t face issue during your travel. Get a free quote instantly online and see for yourself!

Travel insurance information and specifics:

- snow sports travel insurance

- natural disaster travel insurance

- travel accidents insurance

- scuba diving sports insurance

- travel insurance claims examples

Frequently Asked Questions

- What are the advantages of purchasing travel insurance for tourists, and what types of coverage should they consider?

- Advantages include financial protection against unexpected travel issues like medical emergencies, trip cancellations, and lost luggage. Tourists should consider medical coverage, trip interruption, and baggage loss coverage.

Michel Pinson is a Travel enthusiast and Content Creator. Merging passion for education and exploration, he iscommitted to sharing knowledge and inspiring others through captivating educational content. Bringing the world closer together by empowering individuals with global expertise and a sense of wanderlust.