How To Transfer Money Internationally?

- How to transfer money internationally?

- 1- Use your bank services

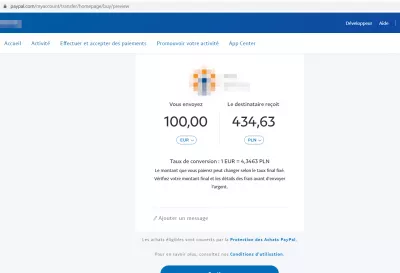

- 2- Use an alternative transfer service

- 3- Transfer money with Paypal

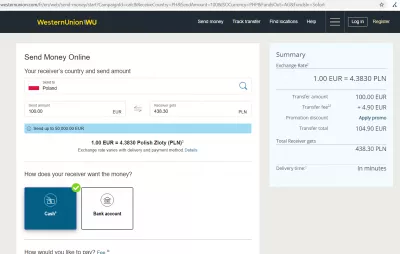

- 4- Transfer money with Western Union

- 5- Transfer money with WISE

- 6- Transfer money with Revolut

- WISE or Revolut?

- Example: transfer from Euro to dollar

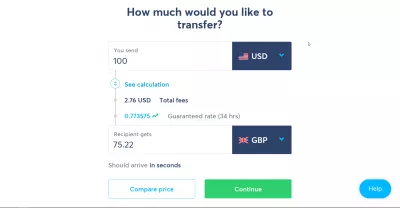

- Example: transfer USD to GBP

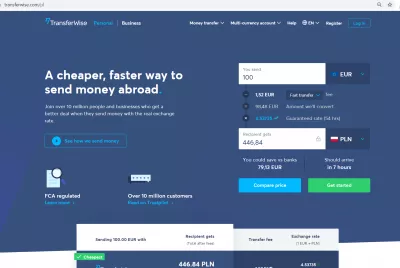

- Example: transfer EUR to PLN

- Frequently Asked Questions

How to transfer money internationally?

If you have been wondering how to transfer millions of dollars internationally, then this article is for you!An international bank transfer in foreign currency is a traditional bank transfer that allows you to send money to any country in the world where banks operate.

Three people always participate in a money transfer: the sender, the recipient and the intermediary - the one who delivers the money to the addressee. Money can be sent through a bank, payment system or mail. Electronic wallets are also used for money transfers.

Working in a foreign country, you need to send some money to a friend or a family member so he can buy a gift for a birthday party. Or, traveling abroad, you need to get some money quickly in order to pay a skydive. Here are the solutions for you.

1- Use your bank services

This section will depend a lot on your bank. Indeed, some banks will refuse every single international transaction. On the other hand, some will let you do what you want with your money. Lastly, some will not give you this possibility on the first hand, but, if you negotiate properly, they will allow you to make international transactions.

So, if you want to do transactions through your bank, you simply have to contact it and ask.

Be careful, your bank may keep a part of the money. Also, make sure that your online transfer limit allows you to do transfer the amount of money to want to send. After having checked this and entered the recipient's bank details, you will be able to choose the amount of money you want to send and you will be able to send it straight away. Note that it may take a few days to arrive.

2- Use an alternative transfer service

This option is often the cheapest option. It can also be the fastest (it depends on your bank once again).

It can also be less safe: some attractive services will attract you saying they do not have any commission, but your money may also never arrive. Make sure to choose a serious alternative service.

If you agree to use an alternative transfer service, you may be asking which one to choose. To help you, here are the top three best alternative transfer services that you can find on the internet.

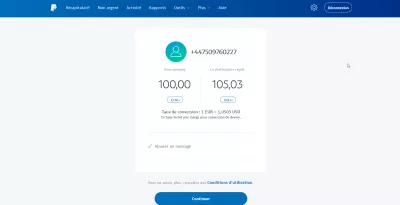

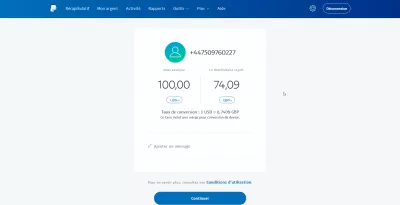

3- Transfer money with Paypal

Paypal is one of them. Founded in 1998, it is now the leader for making online transactions and receiving payments. To make a transaction with Paypal, you first have to create an account.

Once the account is created, you can pretty much do what you want. The commission Paypal takes is around three percent (probably less than your bank).

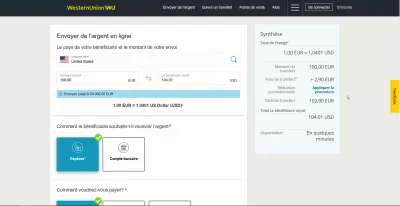

PayPal money transfer website4- Transfer money with Western Union

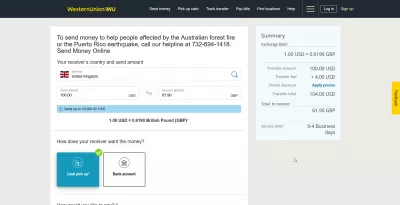

Western Union is another alternative service. Very old, this was created in the 19th century. It was first a telegram sender and receiver, but it now switched to the wire transfer market.

Available in every country, it is another serious service. They will take up to ten dollars on your wire transfers. Be careful, Western Union may have some hidden fees, up to six percent.

Western Union money transfer website5- Transfer money with WISE

Banks can sometimes offer you great fees for transfers. If it is the case, they will probably get money with poor exchange rates. On the other hand, if the fees are high, the exchange rates will be lower. If this is not the case, consider changing banks.

WISE is a good way to avoid fees and still use the bank system. They will send out the money locally, using local bank systems, to avoid fees. WISE uses the real exchange rate that you will find by checking on Google.

It is also a great way to get local bank accounts, and to pay local utilities or bills. For example, I used it to order fresh fruits in Poland when the delivery boy asked me to pay local money transfer, the Polish Przelew in Polish Zloty.

You are even given the possibilities to create two profiles for your account, a personal and a professional profile, thus differentiating your payments and making your whole accounting easier.

WISE international money transfer service6- Transfer money with Revolut

Revolut system is another great way to transfer money in other currencies online and virtually for free, except a very low conversion fee.

It is very similar to its competitor WISE, and also let you order a payment card for free, except postage fee, and to create wallet in local money currencies, thus facilitating payments and allowing you then to pay in local currency without any fee, if your balance in target currency is large enough.

The main advantage of REVOLUT is the possibility to setup money transfer auto exchange as soon as the currency transfer rate reaches your chosen value!

WISE or Revolut?

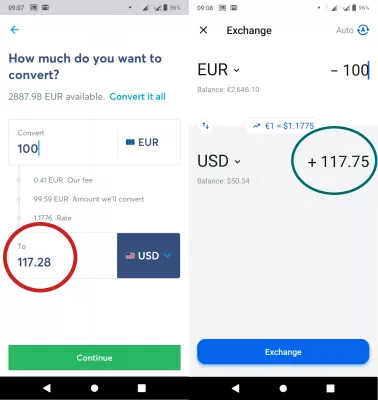

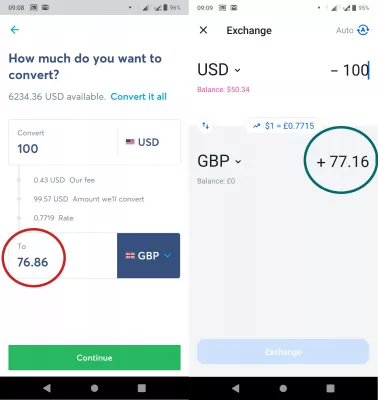

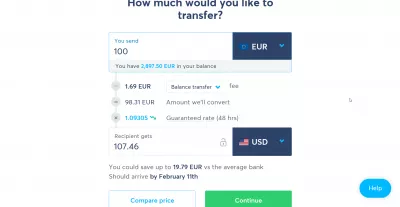

This question is difficult to answer, as both of them offer similar yet different services. According to my own test, as you can see below, REVOLUT seems in some cases to get a better currency conversion fee than WISE but both are very similar.

Both services got amazing services which the other doesn’t have: for example, REVOLUT allows to setup auto conversion with target exchange rate, whereas WISE allows you to get both a personal and professional bank account.

Example: transfer from Euro to dollar

The best way to transfer from Euro to dollar is with the WISE service, as a 100€ transfer from Euro to dollar will get you $107.46 with WISE money transfer service, higher than the $105.03 with Paypal or the $104.01 with Western Union.

But even better, before doing any blind transfer, see for yourself: have a look at the current (or latest if the market is not open) ECB rate for EUR to USD and have a look at the various services and their current final delivery rate, all fees included: you might be surprised!

Example: transfer USD to GBP

The best way to transfer USD to GBP is using WISE as the recipient will get 75.22GBP for a 100USD money transfer, instead of 74.09 with PayPal, and 61.9 with Western Union.

Example: transfer EUR to PLN

Let’s have a look at another example of intra European currency conversion with an EUR to PLN currency transfer from Euro to Poland’s national currency, the Polish Zloty. If we try to send a 100 euros for example, the recipient will receive at the end 446.84PLN with WISE, 438.30PLN with Western Union, 434.63PLN with PayPal.

In other words, WISE is 2% cheaper than Western Union, and your recipient gets 2% more money for the same money transfers without any other hidden fee, and WISE is 3% cheaper than PayPal, and your recipient gets 3% more money for the same transfer.

Frequently Asked Questions

- What are the different methods for transferring money internationally, and what factors should individuals consider to ensure a safe and cost-effective transfer?

- Methods include bank transfers, online money transfer services, and peer-to-peer platforms. Factors to consider include transfer fees, exchange rates, transfer speed, and the reputation of the service provider.